Attract and Retain Top Talent with NexJ CRM for Financial Advisors

In an increasingly competitive climate, financial organizations need to compete not only for market share, but also to attract and retain the industry’s top talent. Advisors are drawn to organizations that promote business growth and allow them to do their work with minimal administrative efforts so that they can focus on revenue generation. Firms must provide their advisors with the latest tools, or risk losing them to the competition.

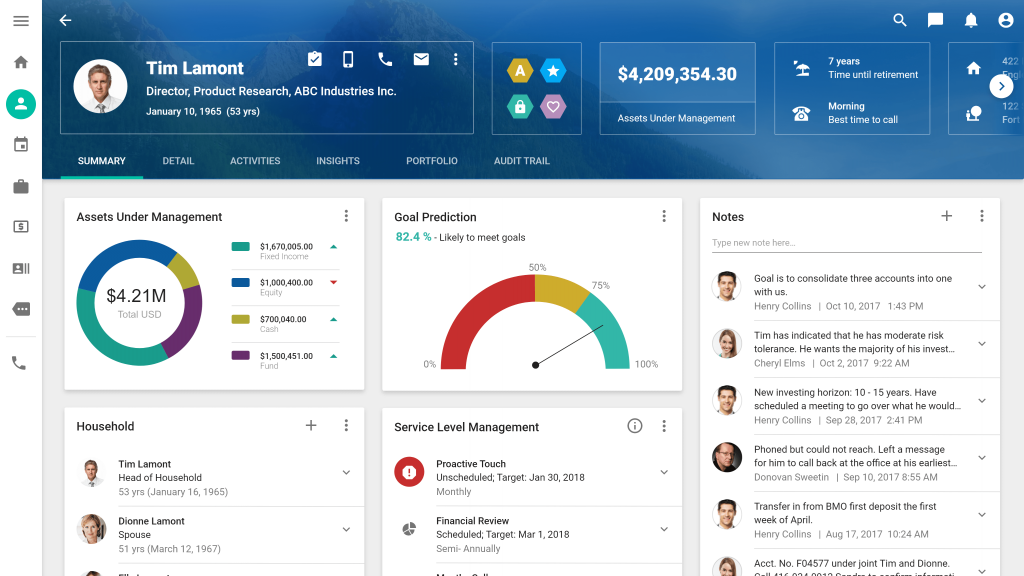

NexJ CRM, designed specifically for wealth management and private banking, helps to attract and retain advisors by providing intelligent CRM technology. Integration is a key factor in any successful CRM strategy. By providing enterprise customer data stored in legacy and back-office systems in a single, integrated view, NexJ CRM for financial advisors minimizes redundant data entry and the need to search through multiple systems for information. Instead, advisors have all the information they need to better understand clients in a comprehensive client view. Through the Integrated Advisor Desktop, advisors also have access to the multiple applications they need to do their job in a single, seamless interface. When advisors feel they are getting far more out of the system than they put in, their acceptance of a system dramatically increases. Integrated CRM aggregates data from enterprise systems, apply business intelligence, and drive intelligent, proactive interactions, saving advisors’ time and deepening client relationships.

Another key feature of modern CRM that attracts and retains advisors is streamlining and automating complex and tedious client-centric business process such as client onboarding, account reviews, and KYC. These business processes, or workflows, are built into NexJ CRM, and can be tailored to suit an organization’s specific requirements. With NexJ’s Intelligent Customer Process Management, the latest information is automatically pulled in from CRM and other integrated data stores at the start of the business process to pre-fill forms, and the users are guided through the data capture process. This significantly reduces the administrative work advisors need to complete.

NexJ provides AI-powered CRM for financial advisors. Features that help to attract and retain advisors include:

- Flexible customer profiles that capture detailed client information with categories and custom fields

- Household & relationship modeling that models client-centric relationships across households, corporations, and spheres of influence

- Account aggregation that rolls up financial data to the client, household, and extended household levels to visualize asset class allocation, risk exposure, and holding correlations at each level

- Client loyalty capabilities that allow firms and advisors to segment clients into tiers and automatically prompt advisors with the right reason to reach out to clients, at the right time

- Quick search across all integrated client data, including profile and asset information to quickly find the information advisors need

- Query and list management to dynamically segment clients into lists based on profile and financial information for sales campaigns and reporting purposes

- Automated document personalization and batch communication to create and distribute personalized emails, letters, and brochures or populate forms instantly with all pertinent client information

- Microsoft Outlook integration to automatically synchronize tasks, contacts, calendar items between Microsoft Outlook, NexJ CRM, and Exchange-enabled mobile devices

- SmartForms and workflow capabilities that streamline and automate client-facing processes like client onboarding and KYC with dynamically branching SmartForms

- News and Research Recommendations that leverage demographic and account information to create a unique interest graph for each client. AI matches the profile with relevant digital engagement content from more than 15,000 publishers and delivers it to end users.

- Market data and news that matches client interests with up-to-date information and delivers it as a feed on the client record, a suggestion for a social media post, and a prompt to the advisor for a proactive, non-financial touch

For more information on NexJ CRM for financial advisors, see our Wealth Management brochure.