Effectively Retain Assets During the Transfer of Wealth by Understanding Intergenerational Relationships

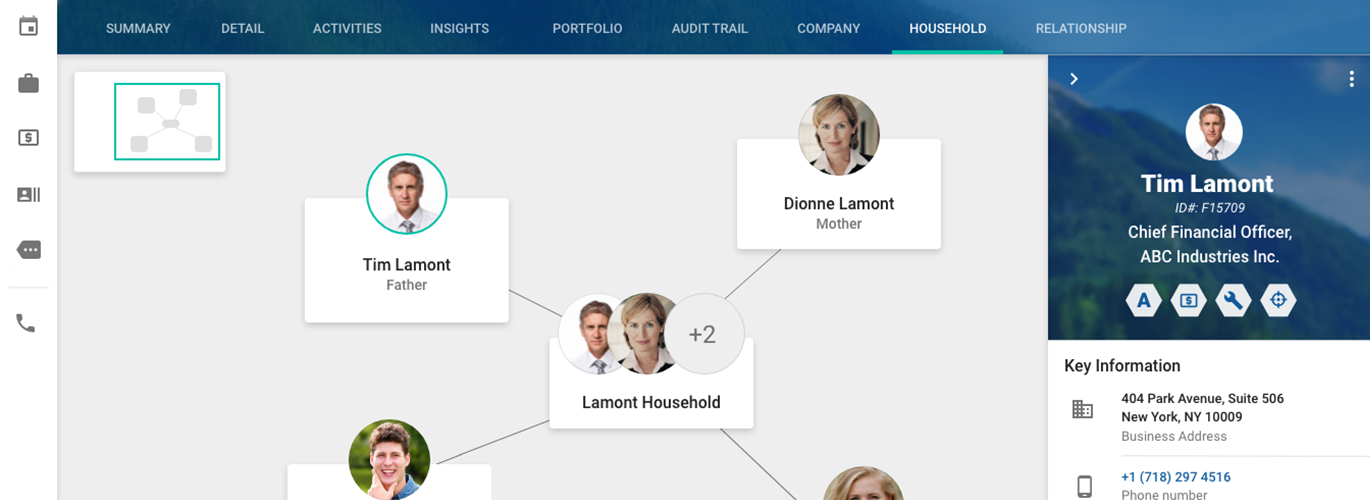

Our robust householding feature provides Relationship Managers with insights around complex relationships including referrals, family relationships, related parties, companies, and groups defined by Relationship Managers. Given the complex nature of private banking clients, this functionality not only lists all products or accounts for which the household has any full or partial ownership but also determines and maintains householding for multiple clients living at the same address or extended households, and manage relationships for multiple clients living at different addresses. In addition, it allows Relationship Managers to better understand all members in a household across generations. By creating strong relationships early on, this understanding is strong when wealth is transferred.

To provide added flexibility, it supports both hierarchical and ad hoc groupings such as associations or professional affiliations.

Householding can assign an unlimited number of parent-child and arbitrary relationships for a contact, such as those between spouses, joint account owners, a client and accountant, trusts, and estates. What’s more – it can support modeling one-to-one, one-to-many, many-to-many, and many-to-one relationships throughout the system.

Let Relationship Managers Put More Focus on Managing Clients

This capability provides Relationship Managers with the ability to:

- Retain assets upon transfer of wealth

- View and manage the financial products, accounts, holdings, and related transactions – from multiple back office systems, for each client, household, or company

- Maintain householding for members of the same household with different addresses

- Provide real-time aggregation of data within a Comprehensive Customer View, offering a complete view of the client’s value

- Roll up and/or aggregated interactions and account information along the defined relationship hierarchies

- Generate reports at any level of the hierarchy

The Value that Our Householding Feature Can Provide You

- Aggregate information along defined hierarchies

- Segment assigned accounts into multiple “portfolios” by creating multiple hierarchies as required

And that’s not all!