Improve Data Analysis and Segmentation Through Our Client Relationship Modelling Functionality

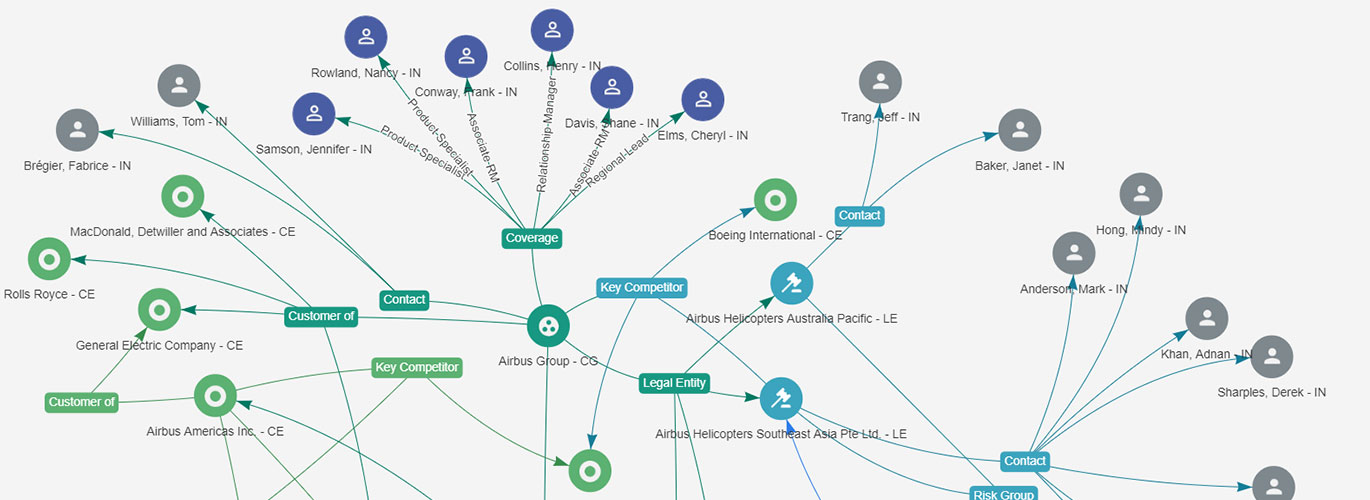

Designed to help business bankers model complex relationships, our robust Client Relationship Modelling feature takes data analysis to the next level. Key use cases include modelling referrals, legal relationships, financial relationships, business relationships, related parties, companies and subsidiaries, and other banker-defined groups. To provide added flexibility, we support both hierarchical and ad hoc groupings such as associations or professional affiliations.

This functionality enables business bankers to better identify and collaborate on cross-sell opportunities across regions.

Let Business Bankers Put More Focus on Managing Clients

Client Relationship Modelling Allows Business Bankers to:

- View and manage financial products purchased, accounts, holdings, and related transactions for each client

- Aggregate data in real-time within a Comprehensive Customer View, offering a complete view of the client’s total value and rolling up account information along defined hierarchies

- Generate reports at any level of the Client Relationship Model

The Value That Our Client Relationship Modelling Feature Provides You

- Make intelligent, data-driven decisions around complex relationships

And that’s not all!