What's your equation for success?

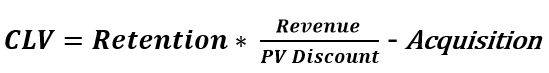

Last time we spoke about the importance of recognizing value immediately through agile implementation methods. This time we are going to apply that to the domain of computing a lifetime value metric. So what is a customer lifetime value metric – without the algebra please! Put simply, it is a metric defining the customer’s monetary worth to the organization, factoring in acquisition, retention and revenue.

Lifetime value is inclusive of loyalty and the customer experience. Loyalty is loosely equated to retention rates or how long a typical customer stays with the organization. Retention could be computed based on customer counts within a time period for each line of business. And acquisition is the cost associated to find, convert and onboard a new customer. Revenue can be complicated, especially when attempting to evaluate the net profit per customer transactions and may be facilitated through Unit Contribution Margin analysis. Note that only the revenue-impacted metrics are subjected to Present Value discount rates.

This is the math without too much algebra and the spirit is to define a revenue-centric metric associated with an individual customer. Segmenting or cohorting customers by purchasing power, spending affinity, or other attribution is key in relating the value to available products or services. From this, behavioral insights are gleaned like the top 10% of customers by lifetime value have purchased certain products or enjoyed certain services. Aligning cohorts, or segments of customers, behind related products or services can not only increase loyalty but better align marketing programs to “boost” a weaker performing cohort into a better performing one. And the performance metric is aligned with lifetime value.

To engrain this behaviour within the organization, a vital feedback mechanism is required. Not surprisingly this feedback is from the participating, preferably connected, customer. These interactions can moderate the strict definition of “weak” or “strong” performer by infusing a measure of perceived value. And if the customer believes it to be a valuable product or service, then they are much more likely to use it, to retain it, or to recommend it.

With NexJ CDM – Customer Data Management, each attribute used in the CLV calculation is mapped to the source system currently provisioning it. And this activity can be started for each line of business so that each department yields CLV metrics based on their own systems, where possible. Views to understand cohort behaviour can be created alongside the LOB views to get deeper or richer insights and could even leverage hierarchies to gain additional insights within or across related customers.

NexJ CDM enables the data integration process supported by an agile implementation methodology that does not require an expensive rip-and-replace. Leverage existing assets where possible, collaborate between and across organizational boundaries by staying focused on the results and reusing across a variety of delivery channels is the NexJ CDM paradigm. The rich integration with a variety of system infrastructures reduces dependencies on technology partners. Automated escalation and resumption patterns simplify operations. And the ability to weave content from differing sources enhances, matures, and amplifies analytic efforts.

How would you use CDM – Customer Data Management to power your analytics efforts? What challenges have you needed to overcome to product CLV metrics? What changes would you make to your methodology? How much labor, resources, or time could you save in your implementation?

We Took On Some The World’s Biggest CRM Vendors. Guess What We Won?

We Took On Some The World’s Biggest CRM Vendors. Guess What We Won?

Recapping CDAO: Examining the Transformation of Risk Management

Recapping CDAO: Examining the Transformation of Risk Management

Here’s Why A Proof Of Concept Can Increase The Chances Of Your Project’s Success

Here’s Why A Proof Of Concept Can Increase The Chances Of Your Project’s Success

Operationalize Business Results with Semantic Modelling

Operationalize Business Results with Semantic Modelling

Want To Make An Important Client Feel Special? Let Our CRM Elevate Your Concierge Service

Want To Make An Important Client Feel Special? Let Our CRM Elevate Your Concierge Service

AI and the Rise of the Bots

AI and the Rise of the Bots

Comments are closed